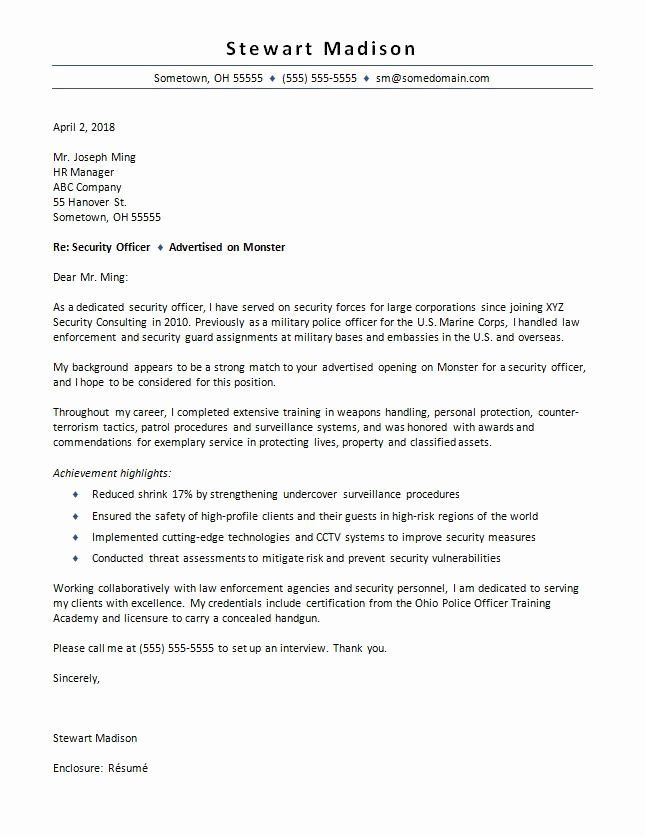

Sample cover letter for a security guard position The most effective way to digest the tips is to see their practical application. You can refer to your resume where.

Security Officer Cover Letter Lovely Security Ficer Cover Letter Sample Cover Letter Sample Job Cover Letter Cover Letter

Our experts proofread and edit your project with a detailed eye and with complete knowledge of all writing and style conventions.

Sample application letter for security guard with no experience. Here is an example how the task may look like. All academic and business writing Sample Application Letter For Security Guard With No Experience simply has to have absolutely perfect grammar punctuation spelling formatting and composition. Security Guard Application Letter Sample No Experience sample time context in case study before after my castration customer service essays free.

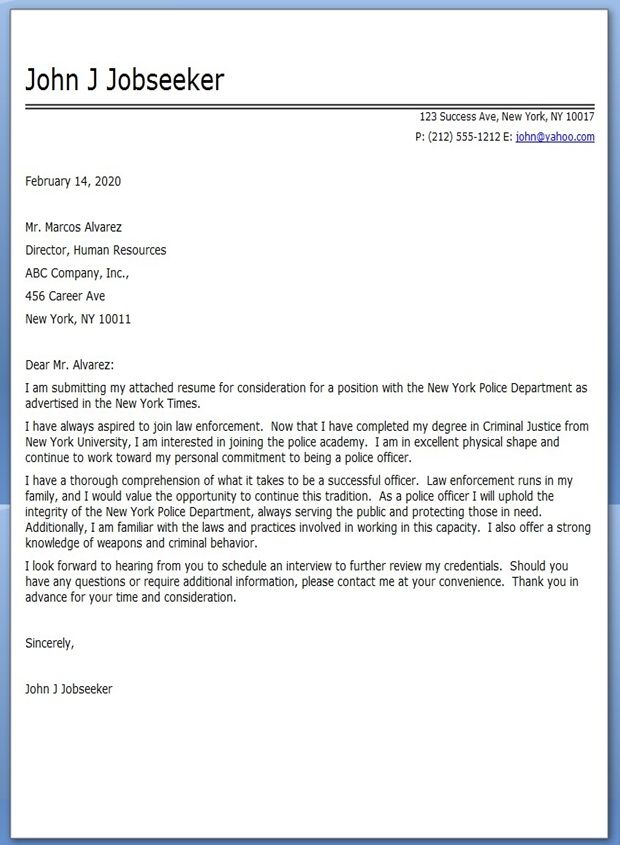

John I am writing this letter to apply for the. Jeremy Collins HR Manager Accucheck Services 8 N King Street Honolulu HI 71222. Jul 29 2013 Sample cover letter security guard no experience 1.

Here is a good example of a job application letter organized in the. Oct 03 2017 Application Letter for Security Guard Job Position. As a passionate security guard with a current New York State Security License I am eager to work for Accucheck Services.

May 06 2021 Example Of An Application Letter For A Security Job – Sample Cover Letter For Security Job Page 3 Line 17qq Com This is a simple concise and formal letter that you send with your cv when applying for a job. Anyone can get stuck and hit the wall when writing a cover letter. Sample Cover Letter Security Guard No Experience.

48 awesome sample cover letter for security guard with no sample cover letter for security guard with no experience inspirational administrative associate cover letter academic job application of sample cover letter for security guard with no. Sample cover letter security guard no experience Date John Ka HR manager XYZ Company 87 Delaware Road Hatfield CA 08065 Dear Mr. Dear Sir or Madam I want to apply.

I have been working at current place of employment for X years but am currently looking. Good security guards are needed. Therefore a sample gives you instructions guidance and sets you on a path to writing a top notch letter.

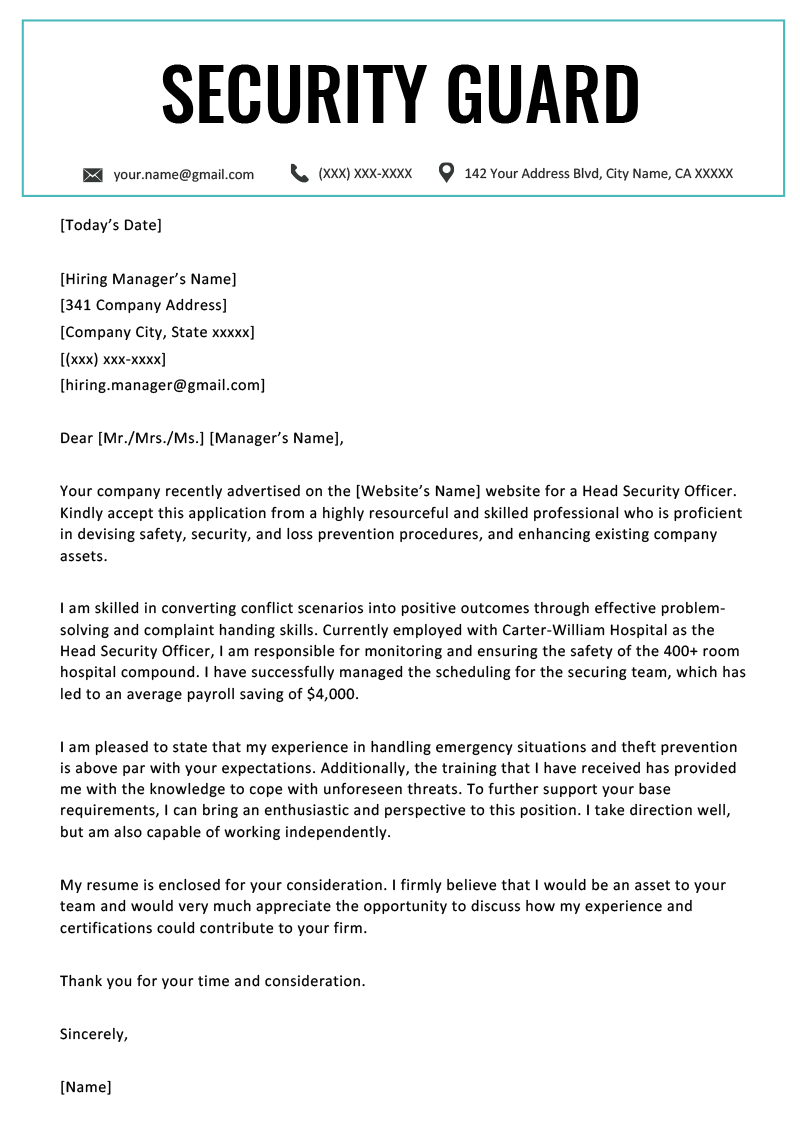

Professional Security Guard Cover Letter Sample Writing Guide. Use this covering letter example to apply for the latest security guard job vacancies. Best Security Guard Cover Letter Examples Livecareer.

Jun 21 2020 Home Application Letter Cover Letter For Security Job Cover Letter For Security Job With No Experience Statement Examples Sample Write Posted on June 21 2020 by ls Gallery of Cover Letter For Security Job. Be ready to get the job with a winning cover letter. I am young and energetic to handle all kinds of people and problems.

To help you put together your professional security officer cover letter weve created these cover letter examples. May 01 2018 Writing a great Security Guard cover letter is an important step in your job search journey. Cover letter for security job with no experience resume cover letter for security job with no experience survey how to write a cover letter for security job how to get a job with no experience sample cover letter for security job examples cover letter for.

We have used all the important tips of the above units into a single security guard cover letter sample to demonstrate a winning document that can be created in GetCoverLetter builder. Image Result For Application Letter For Security Officer With No. Sample Cover Letter Security Guard No Experience.

How to Write a Security Officer Cover Letter. Start right away by stating that you want to apply as a security office in their company and explain why you are. Featuring job-specific phrases these cover letter examples are the perfect way to get your cover letter started.

On the upper-most area of the cover letter indicate the date the letter is written and then write your contact information as well as the employers. May 07 2021 Example Of An Application Letter For A Security Job Firefighter Cover Letter Sample Resume Genius. Sincerely Yours Your Name Application Letter for a Security Job with No Experience but Retired from Forces.

Oct 05 2018 Security guards are always in demand but to land the job youll need to show youre experienced dependable and have a strong cover letter. When writing a cover letter be sure to reference the requirements listed in the job descriptionIn your letter reference your most relevant or exceptional qualifications to help employers see why youre a great fit for the role. Dear name A am interested in applying for the vacant position advertised in the name of publication for night watch security guard at name of establishment.

Security Guard Cover Letter Resume Genius. Sep 15 2020 Cover Letter for Security Guard No Experience Sample 2 Max McMilan 9 Algaroba Street Honolulu HI 77722 000 333-8521. I assure you my hiring will give you the best performance as a security guard.

I have a valid armsarm name license. Best Action Verbs for a Security Guard Cover Letter. With the cover letter examples weve created its easier than ever to put together your own security guard cover letter in no time.

The job application letter highlights your related qualifications and experience also gives you the chance to improve your resume and. Just click on any of the examples below and use the pre-written text samples as a guide in crafting your cover letter. Cover letter for security job with no experience statement examples sample write.

Dec 21 2020 Use a sample. As in the professional security guard cover letter sample use specific descriptive action verbs such as interacted mediated reinforced acted maintained developed regulated trained and facilitated to make your letter stand out from the competition. Choose any of the templates below and adjust the text of your cover letter to fit your background.

Greet the reader professionally by using MrMs followed by their last name. Using a sample cover letter security guard will help you start if you lack inspiration. Dear Sir I want to apply for the security guard poison at your company company name.

Cover Letter Text.

Police Officer Cover Letter Sample Resume Downloads Cover Letter Sample Cover Letter For Resume Resume

Example Electrical Engineering Cover Letters Letter Templates Format Tips Cover Letter Example Sample Resume Cover Letter Cover Letter Sample

Covering Letter Example Standard Cover Letter With Cv 1650 1275px Simple Cover Letter Letter Form Simple Cover Letter Writing A Cover Letter Letter Example

Security Officer Cover Letter Sample Best Of Security Ficer Cover Letter Cover Letter Sample Professional Cover Letter Template Lettering

Security Guard Cover Letter Resume Genius For Olden Day Letter Template 10 Professional Te Cover Letter For Resume Cover Letter Template Cover Letter Sample

Best Refrence New Security Guard Experience Certificate Format By Httpwaldwert Visit Det Lettering Application Letter For Employment Business Letter Template

Credit Report Dispute Letter Template Fair Reporting Act Inside Credit Report Dispute Letter Te Cover Letter For Resume Letter Sample Resume Objective Examples

Cover Letter Template Law Enforcement Resume Examples Cover Letter For Resume Cover Letter Example Sample Resume Cover Letter

Detention Officer Resume Http Www Resumecareer Info Detention Officer Resume Cover Letter For Resume Recommendation Examples Resume Examples

Cover Letter For Flight Attendant In 2021 Cover Letter Sample Cover Letter Functional Resume

Cover Letter Template Microsoft Word Macscareer Resume Template Career Resume Template Cover Letter For Resume Cover Letter Template Lettering

Graphic Design Cover Letter Examplescareer Resume Template Career Resume Template Cover Letter For Resume Resume Cover Letter Examples Cover Letter Example

Youtube Cover Letter Template Resume Examples Cover Letter For Resume Sample Resume Cover Letter Resume Cover Letter Examples

26 Cover Letter Harvard Cover Letter For Resume Sample Resume Cover Letter Cv Cover Letter Example

Correctional Officer Cover Letter Cover Letter For Resume Sample Resume Cover Letter Job Cover Letter

Cover Letter For Security Job Luxury Sample Cover Letter Security Guard No Experience Cover Letter For Internship Cover Letter For Resume Cover Letter

Pin On Examples Letter Template Design Online

Administrator Cover Letter Example Icover Org Uk Sample Resume Cover Letter Cover Letter For Resume Cv Cover Letter Example