What is the joining letter. An employer is more likely.

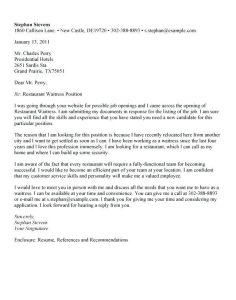

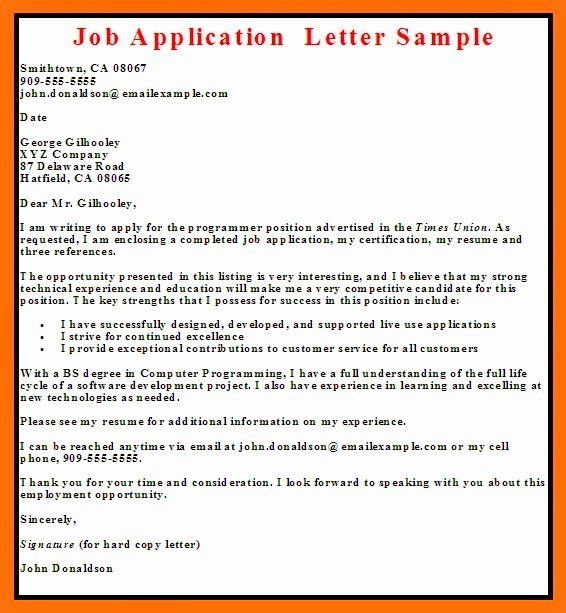

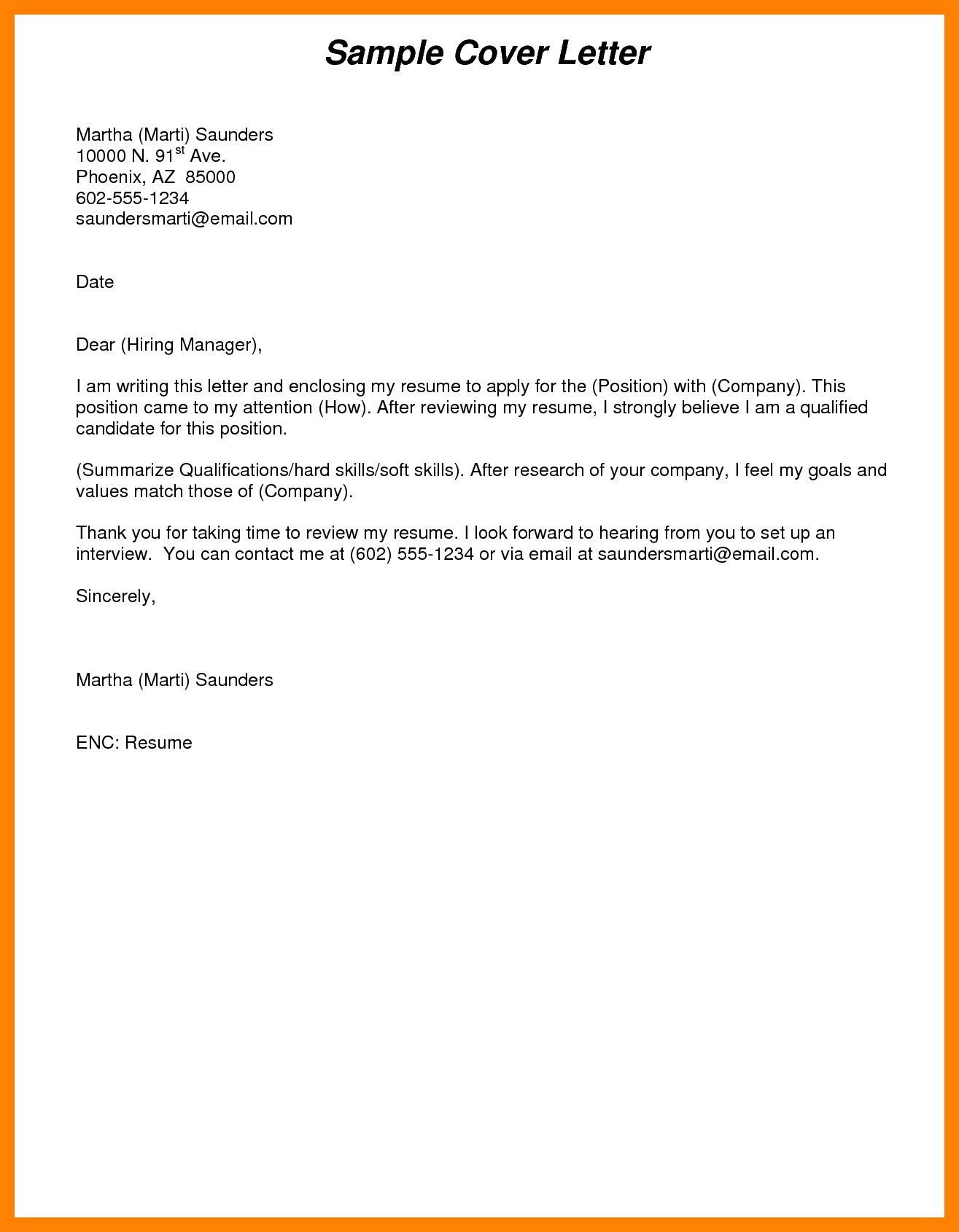

Letters Of Application Examples Luxury Business Letter Examples Job Application Let Job Application Letter Sample Job Application Cover Letter Job Cover Letter

Our clients have achieved outstanding success since.

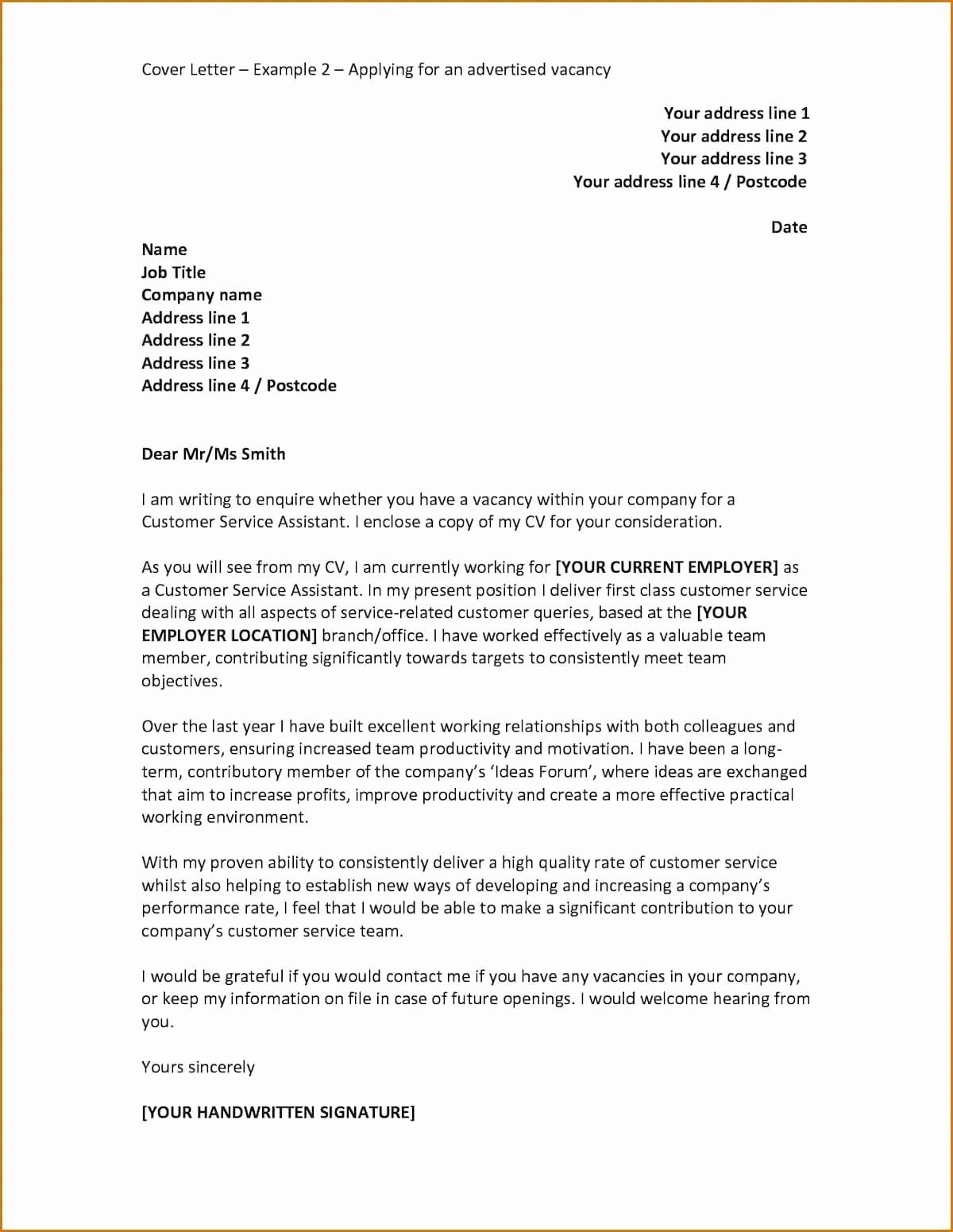

To write a letter for job. Here are the most important things to remember when writing. Make you the subject. If possible find out the name of the hiring manager so you can personalise the letter.

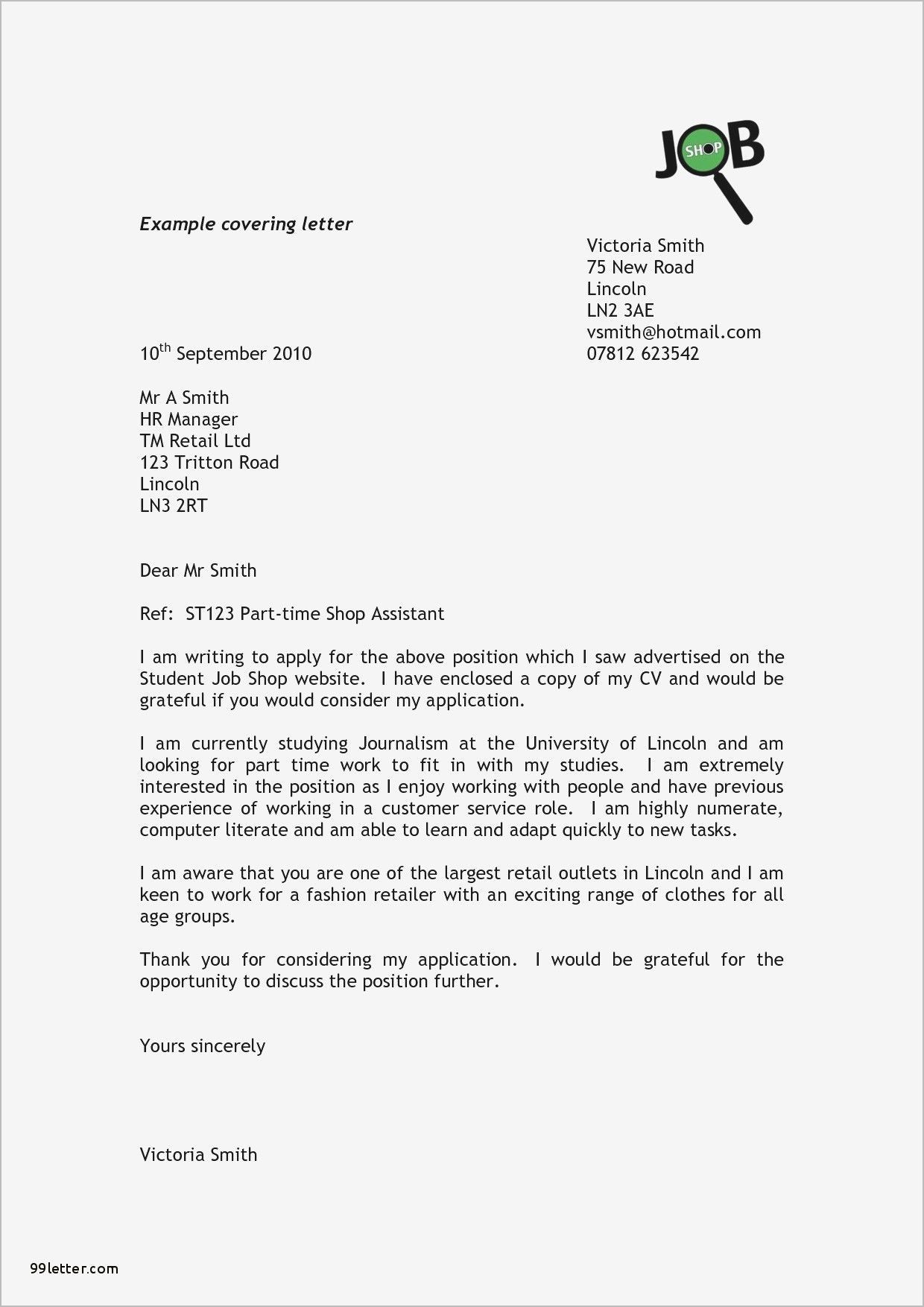

Read carefully the. A solid letter details your qualifications highlights key professional achievements and demonstrates your knowledge of the company and the job youre applying for. Red Tape Busters are your specialist professional selection criteria resume and job application writers.

While you can also briefly mention why you are a strong candidate this section should be. But its important to think. Many experts recommend that you commit to using part of your cover letter to deal with gaps.

You will report to person at location. Reread the job listing circling any keywords such as skills or abilities that are emphasized in the. As you are writing keep the job posting and the companys mission statement open in separate tabs in your browser for easy reference.

The joining letter conveys the joiners acknowledgment acceptance of term and condition. Jan 22 2021 Top tip. Your start date is start date.

Express your appreciation to the hiring manager for reviewing your letter. – How To Write A Cover Letter For A Job In 2021 12 Examples. The generalised To Whom it May Concern is not an appropriate salutation.

The joining letter is the letter of intimation to the employer regarding the acceptance of the offer of a job. May 08 2021 How To Write An Employment Gap Explanation Letter. You can also copy and paste the job requirements you.

Mention the job title and company name and also where you came across the job listing. Mar 18 2021 When writing a letter for applying to a job addressing a specific person like the companys HR or manager is very important. The new generation of college grads are on the fence about whether or not to write a cover letter when applying for a job.

Describe your past experience in a way that emphasizes your personality and skills while also showcasing how you align with the goals of the company. Keep your letter under a page long with no more than about four paragraphs. In your first paragraph explain why you are writing.

If an employer wants a professional reference then the writer of that letter probably worked with the candidate in a supervisory capacity. Some employers will also be interested in letters from a colleague or occasionally a friend neighbor or family member. Your job responsibilities will be job responsibilities.

Cover letter Sample For Research Assistant Job. May 04 2021 People who write them and read them say they hate cover letters but what they really hate are boring formulaic jargony two-pagers. Use professional language and avoid SMS jargons and slang.

When youre requesting a job the reason you would be an ideal candidate for the position should be explicitly mentioned. Feb 23 2020 How to write a project coordinator cover letter. Nov 05 2018 A job offer letter or employment offer letter is designed to formally offer a job to a candidate.

Your skills and experience will be an asset to our job department. Mar 22 2021 Use keywords. Feb 11 2021 A letter of intent for a job follows the business letter style of writing and should open with a formal salutation such as Dear Madam Dear Sir or Dear Hiring Manager.

It provides an introduction of the position the company and other relevant job details including the start date compensation benefits and work hours that will help the candidate decide whether or not to accept the job offer. Mar 04 2021 Discuss some of your qualifications that would make you a good fit for the job. Oct 06 2020 Here is a basic format for a job offer letter.

A cover letter is often the first time a hiring manager gets the chance to meet you so dont waste it. Mar 11 2021 Get off to a direct start. Company name is pleased to offer you the position of job title.

May 07 2021 A good application letter can mean the difference between landing a dream job or having your resume hit the slush pile never to be seen again. In order to hold weight a recommendation letter should come from a reputable source.

3 Paragraph Cover Letter Template Resume Format Job Application Letter Sample Application Letters Job Letter

Simple Job Cover Letter Examples New Employee Writing Good Application Letter Example Job Job Cover Letter Examples Job Cover Letter Letter Template Word

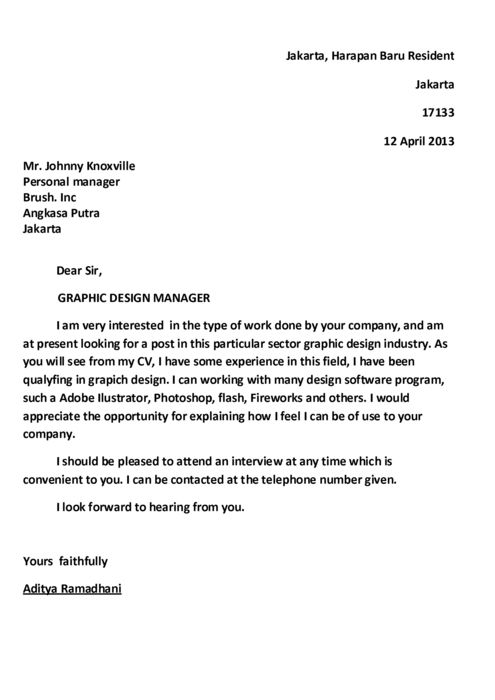

Write A Letter Of Application Application Letters Job Letter Job Application Letter Template

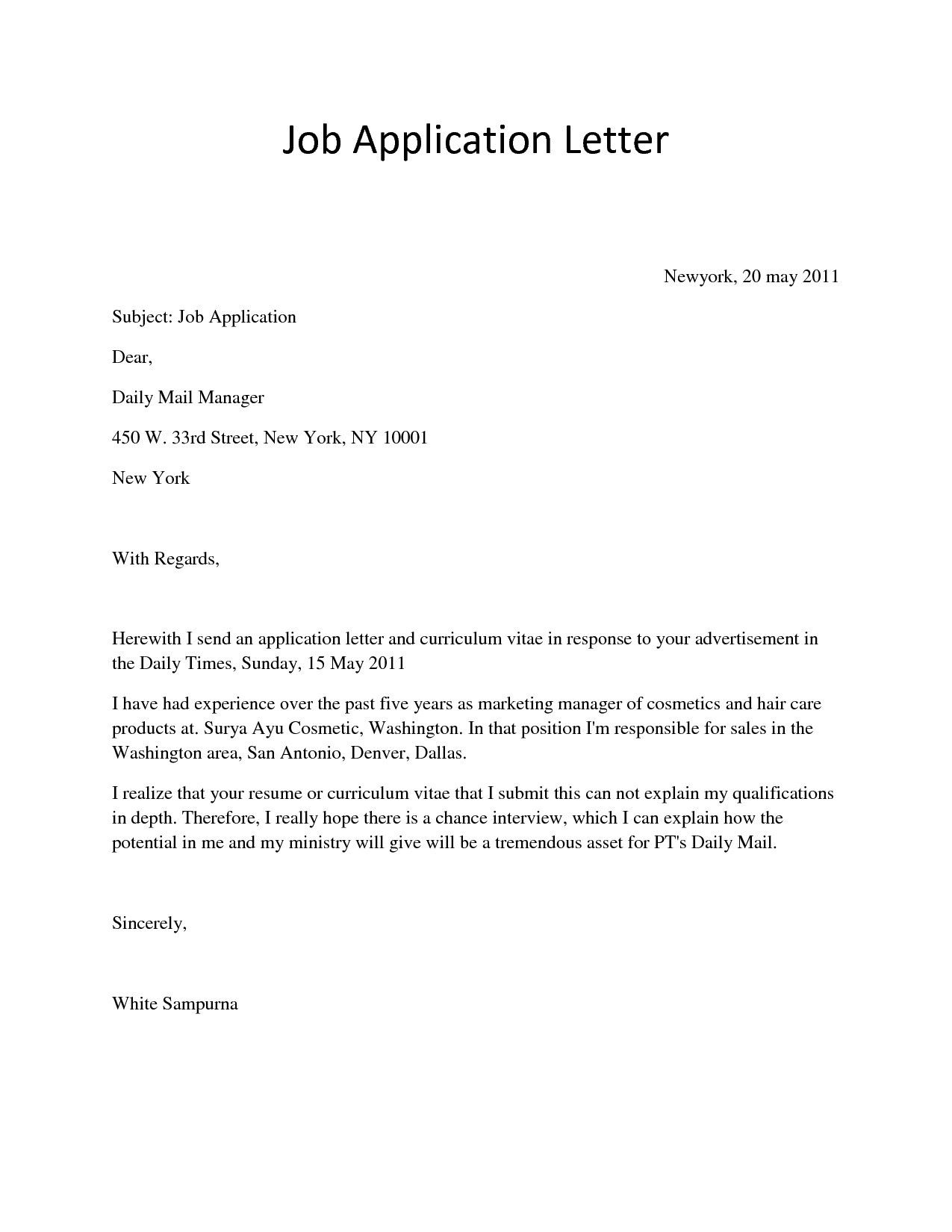

Cover Letter Template Ngo Cover Coverlettertemplate Letter Template Simple Job Application Letter Simple Application Letter Job Application Cover Letter

Letter Of Employment Application Application Letters Job Application Letter Sample Application Letter Sample

Job Application Letter Sample Application Letter For Teacher Job Application Letter Sample Job Cover Letter

27 Cover Letter Formats Job Application Letter Sample Job Cover Letter Cover Letter For Resume

Application Letter For A Job Not Advertised New Job Application Job Cover Letter Application Cover Letter Application Letter For Teacher

26 Cover Letter For Applying Job Job Cover Letter Job Application Cover Letter Application Cover Letter

Sample Cover Letter Job Application South Africa Food Ideas Job Cover Letter Application Cover Letter Job Application Cover Letter

26 Cover Letter Template For Job Application Job Letter Application Letters Cover Letter For Internship

Unique Application Letter For Job Vacancy Sample Application Letters Job Cover Letter Job Application Letter Sample

Writing An Application Letter For Employment Writing An Application Letter Application Letter For Employment Application Letters

25 Writing A Good Cover Letter Job Cover Letter Writing A Cover Letter Job Application Cover Letter

Letters Of Application Examples Best Of How To Write An Application Letter For Employment In Gh Job Cover Letter Writing A Cover Letter Cover Letter For Resume

Job Acceptance Letter Sample Job Letter Acceptance Letter Business Letter Format

Applications Letter Simple Job Application Letter Application Cover Letter Application Letters

26 Cover Letter Sample Pdf Cover Letter Sample Pdf Business Letter Example Pdf New Exampl Job Cover Letter Writing A Cover Letter Good Cover Letter Examples

Written Application Letters Job Cover Letter Job Cover Letter Examples Writing A Cover Letter